Visit Our Online Shop

Follow Us

Bilton Veterinary Centre

259 Bilton Road

Rugby

Warwickshire

CV22 7EQ

Reception: 01788 812650

Repeat Prescriptions: 01788 817462

In-Patients: 01788 813498

PET INSURANCE

Let us help you try and navigate through this complex area of Pet Care.

How can pet insurance help you?

Like humans, pets can suffer an illness or injury at any time. As there is no NHS for pets, you need to consider how you would cover the cost if your pet needs treatment. Pet insurance can help you get your beloved pet back on their feet without worrying about the cost of veterinary bills.

Vets can now do more for pets than ever before but pet owners are often surprised by the cost of veterinary bills and unaware that some conditions require ongoing treatment.

There are specialist tools and techniques that can be used to give your pet the best possible diagnosis and care but costs can soon mount up. Pet insurance can help cover these costs and allows you to budget monthly rather than worrying about paying unexpected veterinary bills.

Lifetime Policies

- Cover is provided up to a set amount for veterinary fees and refreshed each policy year.

- No time limit on how long you can claim for each illness or injury as long as you renew the policy each year without a break in cover.

- Ideal if your pet develops an ongoing condition such as arthritis or diabetes.

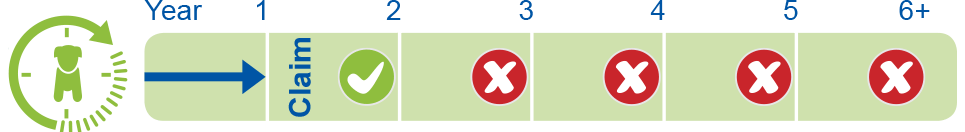

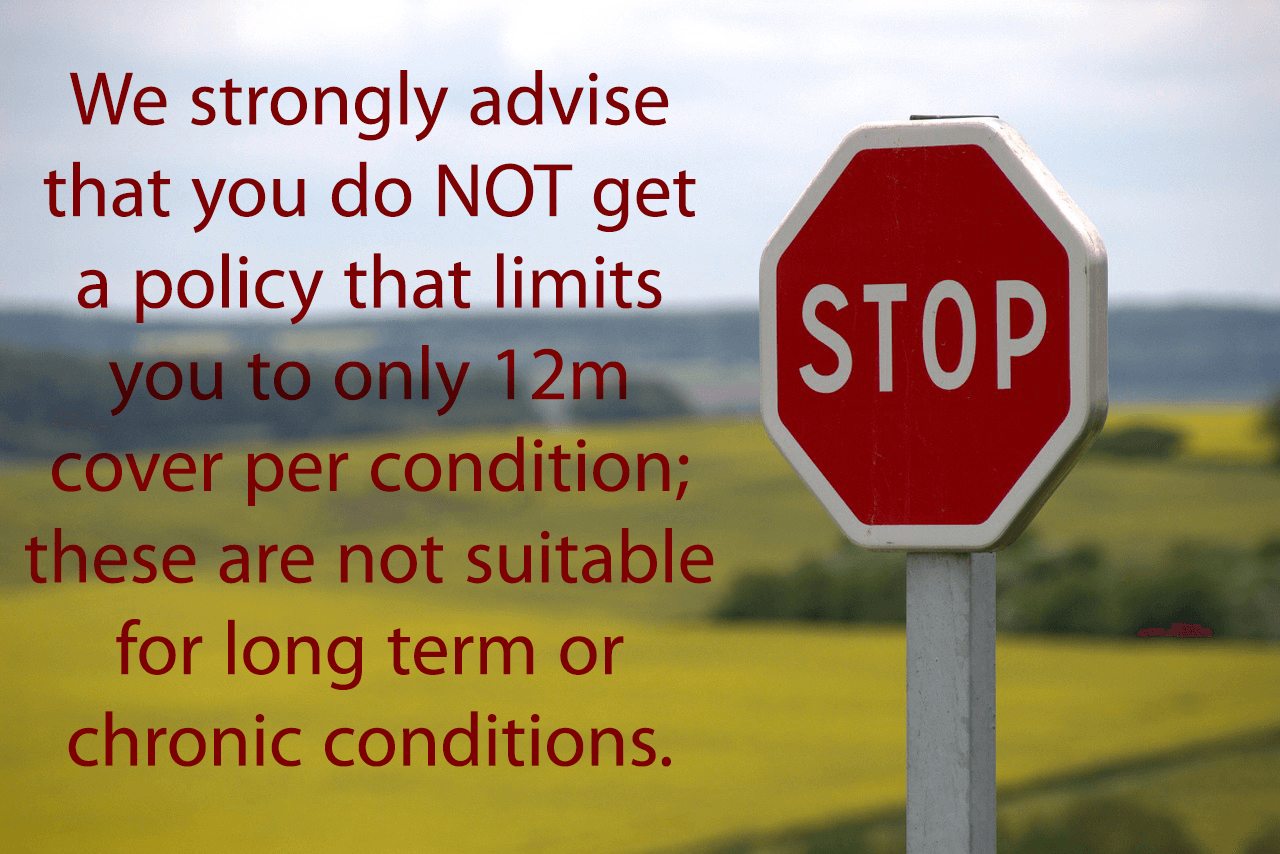

12 month/Time-limited policies

- Cover is provided up to a maximum amount per condition.

- There is a 12-month limit, meaning conditions will only be covered for the first 12 months.

- After 12 months the condition will be excluded from the policy.

- Some policies may only cover up until the time of the next renewal.

Benefits of pet insurance:

- Peace of mind in the event of illness or injury

- Financial help to cover the cost of unexpected treatment

- Able to make decisions based on what’s best for your pet without worrying about the cost of treatment

- May allow you to seek veterinary advice sooner

- Improved treatment options and outcome for your pet

What else should you consider?

Excess

The excess is the contribution you make towards the cost of a claim. It is important to check what excesses apply as some insurance policies have a % excess in addition to a fixed excess. The excess is usually deducted from your claim settlement.

Additional Cover

Some policies will not only cover the cost of veterinary bills but also include cover for the cost of advertising and a reward if your pet gets lost or stolen. And, can even help with legal costs if your pet causes an accident, injury or damage to someone else’s property.

Pre existing conditions

Pet insurance does not usually cover pre-existing conditions that occurred before the start of a policy. It is important to get the right cover from the start as switching to a different policy could cost you more in the long run if your pet already has any illnesses.

Price

Not all pet insurance is the same so don’t just shop around on price alone. It’s also important to check how the cost of your policy will change over time. Most policies increase in price as your pet gets older but some insurers also increase your premium if you claim and others don’t.

Questions you may find useful to ask when shopping for pet insurance

- Can you pay my vet directly? We will generally only deal with certain

insurance companies directly. Please ask for further advice.

- Are you a pet insurance specialist?

- Will you cover my pet into old age?

- Will my premium or excess increase if I make a claim?

- Does the policy cover congenital, hip related or hereditary illnesses?

- Does this policy cover dental treatment and behavioural problems?

- Does this policy place limits on particular conditions or medications?

- Is there a time or monetary limit on how long this policy will cover ongoing conditions for?

Is it just vet's fees that are covered?

Not usually. Most insurance policies also insure against third party injuries, theft and death of the animal. These are often just as important as the vets fees. For example, if a dog causes a road traffic accident or if a person is bitten, the owner is responsible for any cost incurred should the animal be uninsured.

Some policies can include cover against holiday cancellation and kennelling fees in case of emergencies.

How is the premium calculated?

The premium that you are charged will depend on a number of factors, including:

How does a claim work?

Most policies will have an "excess" figure which the insurance companies will deduct from any claims received. For example, if your policy has an excess of £50 and you acquire veterinary costs adding up to £250, you will receive £200 returned from your insurers. Claims are processed on an "individual condition" basis. This means that the smaller "one-off" problems (for example cat-bite abscess, torn claw or mild stomach upsets) usually aren't claimed for as the costs incurred are often less than the "excess".

Claims are normally made “per-condition” rather than “per-visit” and so if the problem spans over several weeks/months etc, you will only have to pay the excess amount once per policy year.

The normal procedure is for the owner of the animal to pay the full amount of a claim to the veterinary practice, and then we will send a claim for the amount directly to the insurance company along with a copy of our clinical notes and costs. They will check that they agree with the amount being claimed for, and usually then send payment for the full amount (less any excess) directly back to the owner of the animal.

How to make a claim with our practice

Not usually. Most insurance policies also insure against third party injuries, theft and death of the animal. These are often just as important as the vets fees. For example, if a dog causes a road traffic accident or if a person is bitten, the owner is responsible for any cost incurred should the animal be uninsured.

Some policies can include cover against holiday cancellation and kennelling fees in case of emergencies.

How is the premium calculated?

The premium that you are charged will depend on a number of factors, including:

- Insurance company and/or policy within a company that you choose.

- Species of animal.

- Breed of animal (pedigree's are usually more expensive to insure than cross-breeds or mixed breeds). Certain breeds are also more likely require corrective surgery.

- Size of animal - bigger dogs generally incur a higher premium

- Age of animal when you commence the insurance policy

- Value of animal

How does a claim work?

Most policies will have an "excess" figure which the insurance companies will deduct from any claims received. For example, if your policy has an excess of £50 and you acquire veterinary costs adding up to £250, you will receive £200 returned from your insurers. Claims are processed on an "individual condition" basis. This means that the smaller "one-off" problems (for example cat-bite abscess, torn claw or mild stomach upsets) usually aren't claimed for as the costs incurred are often less than the "excess".

Claims are normally made “per-condition” rather than “per-visit” and so if the problem spans over several weeks/months etc, you will only have to pay the excess amount once per policy year.

The normal procedure is for the owner of the animal to pay the full amount of a claim to the veterinary practice, and then we will send a claim for the amount directly to the insurance company along with a copy of our clinical notes and costs. They will check that they agree with the amount being claimed for, and usually then send payment for the full amount (less any excess) directly back to the owner of the animal.

What can be claimed for?

Although most things can be claimed for it is important to remember that insurance won't cover all vet's fees. For example routine checks and general health care ( i.e. vaccination, wormers and flea treatment) aren't usually covered, nor are problems relating to breeding (e.g. caesarean sections, pregnancy scans etc). Many policies don’t cover dental treatment (including extractions) unless the problem has been caused specifically by trauma.

Pet insurance is really there to help financially should "the unexpected" occur. Often the types of situation usually claimed are for emergency treatment (e.g. car accident), diagnostics (blood tests, ultrasounds, x-rays), surgery (e.g. lump removal, biopsies, fracture repairs) and medical treatment (e.g. courses of medication, tablets, injections etc).

Although most things can be claimed for it is important to remember that insurance won't cover all vet's fees. For example routine checks and general health care ( i.e. vaccination, wormers and flea treatment) aren't usually covered, nor are problems relating to breeding (e.g. caesarean sections, pregnancy scans etc). Many policies don’t cover dental treatment (including extractions) unless the problem has been caused specifically by trauma.

Pet insurance is really there to help financially should "the unexpected" occur. Often the types of situation usually claimed are for emergency treatment (e.g. car accident), diagnostics (blood tests, ultrasounds, x-rays), surgery (e.g. lump removal, biopsies, fracture repairs) and medical treatment (e.g. courses of medication, tablets, injections etc).

BEWARE - if you take out a new policy AFTER your pet has been seen for an identical or similar problem before, it will be EXCLUDED.

This also is the case if you change insurance provider.

What is the best advice with regards to taking out a policy?

The decision to take out pet insurance, or which company/policy to go with is going to be based on individual circumstances. However you should always try to:

The decision to take out pet insurance, or which company/policy to go with is going to be based on individual circumstances. However you should always try to:

- Check the small print - do they cover chronic conditions or long term treatment?

- Talk to friends with animals - see if they have had particularly good or bad experience with insurance companies.

- Take out insurance early - the unexpected can happen at any age or at any time. Don't wait for a problem to occur as this is likely to be excluded from any insurance policy

- Talk to your vet or veterinary nurse - we are always able to help and sometimes advise on which type of policy may be better for you.

- Look at the broad picture - the policies with the cheapest premiums may not be the best. It is often a case of you get what you pay for!

Quick Links

Contact Us

Bilton Veterinary Centre

259 BIlton Road

Rugby

Warwickshire CV22 7EQ

Tel: 01788 812650

email: enquiries@biltonvets.co.uk

Opening Hours

- Monday

- -

- Tuesday

- -

- Wednesday

- - -

- Thursday

- -

- Friday

- -

- Saturday

- -

- Sunday

- Closed